One of the most pressing issues that young Americans face is financial instability. According to Forbes, Americans 18-29 years old owe at least $1 trillion in debt. As high schoolers transition into adulthood, financial literacy is becoming increasingly essential to ensure future stability. Vivan Kotla, a Lambert junior, is tackling this issue head on.

Recently appointed as one of two Forsyth County students on the Georgia Superintendent’s Student Advisory Council, Kotla will serve on a statewide board of 80 students who meet four times a year to advise State Superintendent Richard Woods on educational improvements.

“We represent each of our different counties and schools, and we’re going to be assisting Superintendent Woods,” Kotla explained. “We’re advising him using our perspectives from different schools and anything that we think we could improve in the education system.”

For Kotla, one issue stands out the most: financial literacy.

“In Forsyth County, I think that a lot of the issues revolve around how we are very focused on, like, GPA … and making our GPA the highest it can be,” Kotla described. “ And while I think it shows how we’re all very ambitious students, I think something that is really important is financial literacy and more of those classic job skills that you need for the future.”

Currently, Georgia is one of the 29 states that require students to take a financial literacy course for high school graduation but not as an independent course. Kotla hopes to change that by proposing a more structured, accessible model through the Department of Education.

As part of the council, Kotla has to create a service project aimed at helping students overall. Though he is just starting in this new position, he already has a vision for the things he wants to accomplish, specifically establishing financial literacy workshops alongside other school courses.

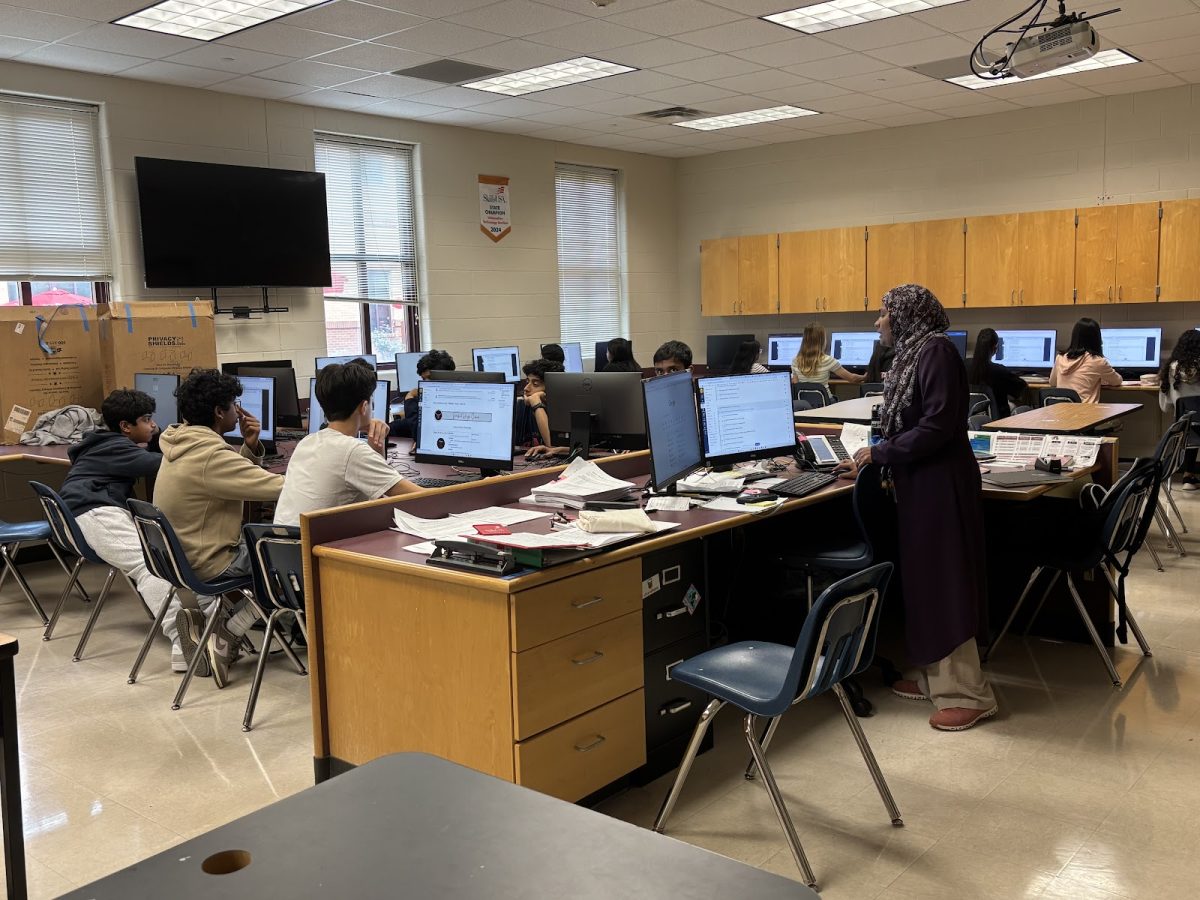

“We can have these workshops hosted by the GADOE, where either we can teach it [financial literacy] to teachers and those teachers bring it to their students, or we directly bring the students straight to online meetings,” Kotla stated. “ We can also have in person meetings throughout each county. One thing I pose is that we have county level representatives who will lead these workshops… because each county has their own different needs and their own eligibility requirements.”

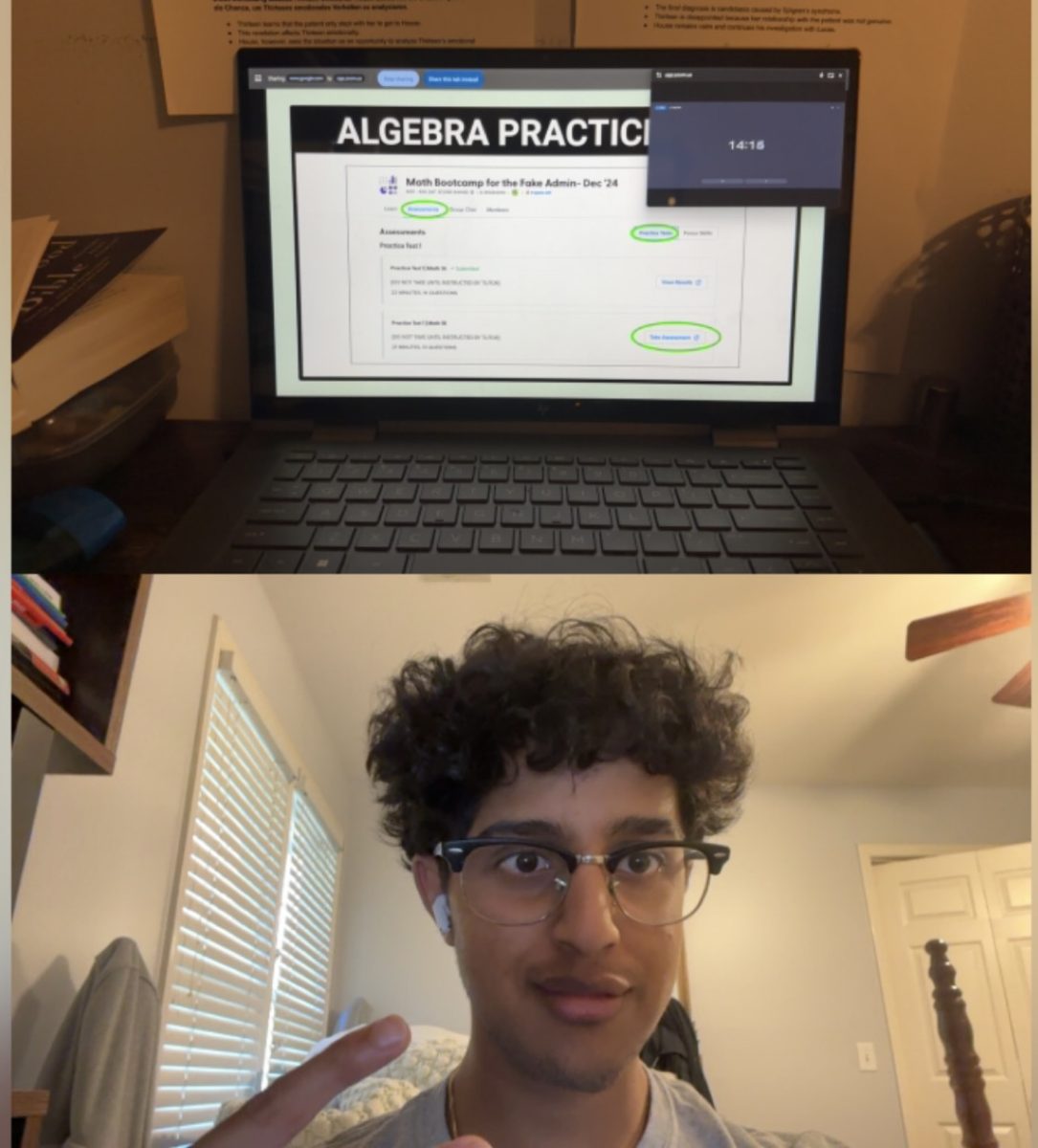

Beyond his work on the council, Kotla has already taken steps to make financial literacy more engaging for students. He is currently developing a nonprofit startup called Orythe, a platform that uses gamification to teach financial skills and raise scam awareness.

“I’d like to say that it functions as something similar to Duolingo, but for financial literacy,” Kotla said. “I’m hoping that in the future, we could really partner or with something like the Student Advisory Council, and we can implement this into the GADOE…and it would work into the financial literacy Capstone and you could get a certification from this program.”

Looking ahead, Kotla hopes his experience on the council will help him pursue his growing interest in education policy, where finance and learning intersect.

“Policy is something I’m really interested in,” Kotla added. “So this[the service council] is the perfect crossway for policy and combining education and finance.”

With his startup in motion and a state platform to share his ideas, Kotla is determined to bring financial literacy to all Georgia students.