Global trade, today, is more interconnected than ever before. With the introduction of free trade agreements and global trade organizations like the World Trade Organization (WTO), states have increasingly shifted to a globalist mindset. Tariffs, or taxes on imports, naturally go against a globalist mindset. They are meant to discourage foreign goods and improve the national economy. Tariffs have always been a way for nations to control their affairs with outside nations while maintaining a self-sufficient economy as well.

Since President Donald Trump’s inauguration in January, he has teased tariffs as a way to improve the American economy. From February 1, Trump imposed sweeping tariffs up to 145%, an unseen percent tax on imported goods. While the concept of Trump’s tariffs were similar to other nations, many speculated this dramatic tax’s purpose was to isolate the country. Their broad but meaningful impact means tariffs are important on both a global and local level.

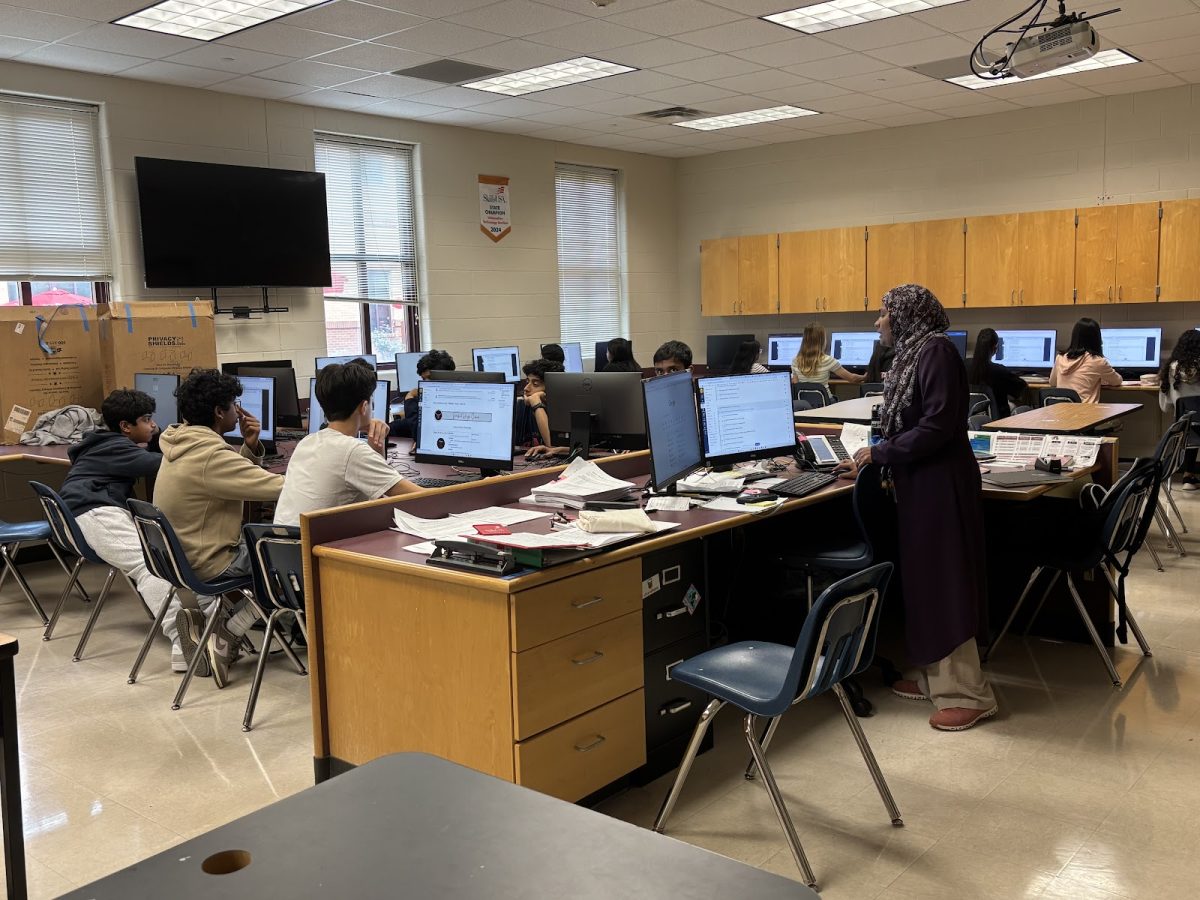

“Tariffs can help protect jobs and make more money for the government,” sophomore Abhay Prashanth explained. “But they can also lead to trade wars like we almost saw between the US and China.”

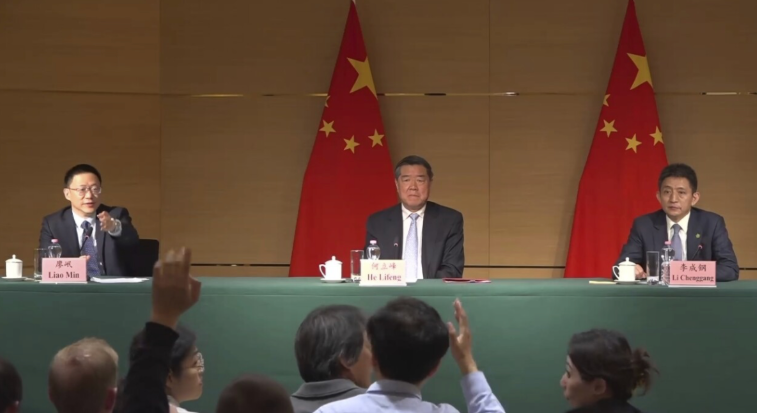

The high tariff percentages were an effect of the US adopting an overall isolationist mindset, prioritizing the state’s economic health over the rest of the world’s. With increasing tariffs on both sides, an agreement was reached May 12 between the US and China to lower tariffs, which prevented a trade war between the two nations. A trade war between the world’s largest economies would have been catastrophic for global markets, making prices shoot up and bringing stock markets to their knees. Tariffs are impactful on the local level as well, affecting day-to-day economics and decisions for ordinary people. The implications of a trade war are severe, and some of their effects have been predicted.

“Tariffs could help promote jobs locally but also make prices higher,” Prashanth said.

Tariffs encourage domestic jobs and production since offshore services and goods often skyrocket and become more expensive. The demand for domestic goods would be high when large tariffs are put in place, so the price of all goods would rise. Domestic goods’ prices are affected by tariffs indirectly, and foreign goods are affected by tariffs directly. An all-out trade war, especially between powerful global players, would exemplify some of the standard effects of tariffs.

While tariffs can seem to be simple political tactics, they are impactful on both a global and local level. Even though they are broad taxes meant to affect the global economy, consumers on a local level can feel the negative impact of inflation as well as the positive effects of a self-sustaining economy. Despite the all-out trade war between the world’s most dominant economies was prevented, it is important to understand the positives and negatives of tariffs to better understand politics and changing economic dynamics locally and globally.