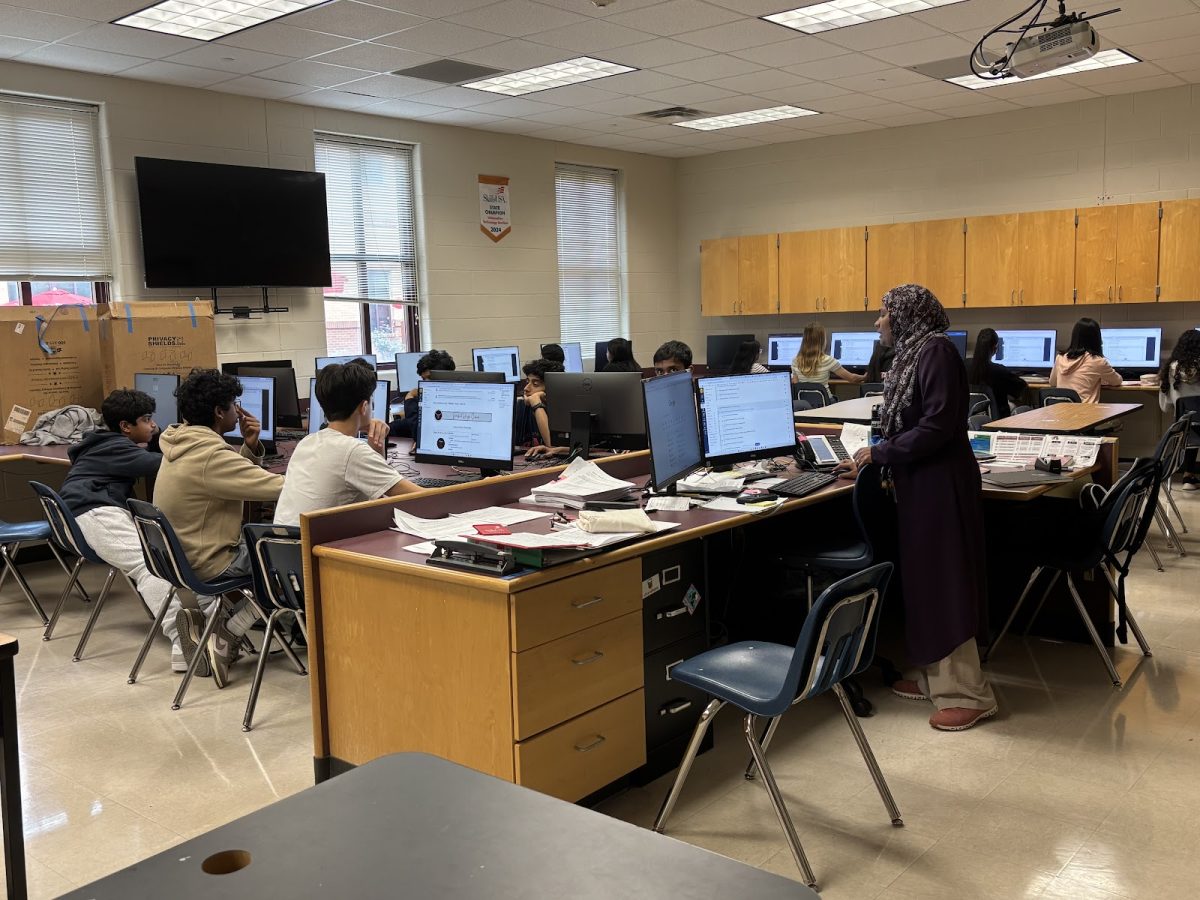

As 2023 comes to a close, the college application process for the Class of 2024 intensifies with early decisions rolling out and regular decision deadlines approaching. Changes to this year’s Free Application for Federal Student Aid (FAFSA) adds an extra layer to the already tedious task of securing financial aid for their academic careers.

“I think the biggest thing is it was a real pain to fill out,” Lambert counselor Travis Church said. “It was a pretty long and convoluted application originally, so they made it a lot shorter and just a bit more user friendly.”

The FAFSA form is an application that students in the United States fill out in order to receive financial aid from the federal government for their college careers.

The latest modifications to FAFSA are a result of the implementation of the new FAFSA Simplification Act. The act addresses crucial aspects of the financial aid process, ranging from the FAFSA form itself to how eligibility for aid is determined.

For starters, there’s a notable change in the timeline of the FAFSA process. In the past, the application opened on October 1. This year however, the 2024-2025 award year application will open by December 31, 2023.

“I feel really good about this because now I can get my applications done and focus on financial aid later,” Lambert senior Stephanie Sun said.

Additionally, the act also increases the number of colleges students can list on their application. Students can now add up to 20 colleges on the online FAFSA and ten on the FAFSA PDF, compared to the previous limit of ten across both platforms.

“I think [the biggest change is] that you no longer have to enter your IRS stuff, you can kind of just click a button and have it populate for you,” Church explained.

In the past, contributors had to manually enter their Internal Revenue Services (IRS) information into the FAFSA application to determine aid eligibility. Now, contributors can simply consent for their federal tax information to be automatically transferred to the FAFSA, removing the need for manual entry.

Another significant change occurs in the actual calculation of financial aid with the Expected Family Contribution (EFC) being replaced with the Student Aid Index (SAI). While the SAI no longer takes into account the number of family members in college, it makes it easier for students to qualify for Pell Grants and receive additional aid. This change allows for over 610,000 low-income students to now be eligible for Federal Pell Grants.

“There are a ton of ways [to receive financial support],” Church said. “If you’re looking at applying to different scholarships, it is hard. You have to take the time to research different opportunities, fill out those applications and each application usually comes with its different set of criteria.”

To aid with the search for scholarships, the counseling department at Lambert has compiled an excel sheet with a list of scholarships seniors can apply to, including details such as deadlines, amounts and application instructions.

Although navigating financial aid can be a challenging and stressful time, staying informed is crucial for students to be successful in securing support for their future academic endeavors.

“The reality is, money is not infinite,” Church explained. “They only have a certain amount of money they can offer to students from a loan standpoint. So the earlier you fill it out, the better your chances are of having most, if not all, of your school covered through federal aid.”